Introduction

In today’s digital-first economy, protecting consumer privacy has become a central responsibility for retailers. As more transactions shift online, people share sensitive information such as names, addresses, phone numbers, and payment details. Even offline retailers now collect loyalty data, track shopping habits, and maintain digital records. With such vast amounts of personal information circulating through different channels, the question becomes: how do retailers ensure that this data remains secure?

For consumers, privacy protection is not just about security—it is also about trust. When people interact with a retailer, they want to know their information will not be misused, sold without consent, or exposed to hackers. For retailers, safeguarding this data is both a legal requirement and a competitive advantage. Let’s explore in detail the many ways retailers protect consumer privacy.

1. The Importance of Privacy in Retail

Retailers depend on building long-term relationships with their customers. Trust is at the core of those relationships. If customers feel their data is not safe, they may turn to competitors. Privacy concerns can damage reputations, lead to financial penalties, and result in significant business losses.

In addition, regulatory frameworks like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States require businesses to handle data responsibly. Retailers who fail to comply can face fines and legal actions.

Protecting consumer privacy, therefore, is not simply optional—it’s essential for sustainable growth.

2. Data Collection with Transparency

The first step in privacy protection begins with transparency. Retailers now clearly communicate what data they collect, why they collect it, and how it will be used. This includes:

-

Explaining the purpose of data collection at checkout, in apps, or on websites.

-

Offering opt-in or opt-out choices for email marketing or loyalty programs.

-

Providing privacy policies written in plain language rather than complicated legal terms.

When customers know what is happening with their data, they are more likely to feel comfortable sharing it.

3. Data Minimization Practices

Another way retailers safeguard privacy is through data minimization. Instead of gathering every piece of possible information, many retailers now collect only what is necessary. For example:

-

A store loyalty program may only require an email and phone number, not a full address.

-

A checkout system may not store payment card numbers after the transaction is completed.

-

Some retailers anonymize shopping behavior data instead of linking it directly to individuals.

By minimizing the amount of personal information collected, retailers reduce the risks in case of a security breach.

4. Secure Payment Systems

Retailers that process payments must prioritize security. To protect consumer privacy during financial transactions, they employ:

-

Encryption: Data entered during checkout is encrypted so that hackers cannot read it.

-

Tokenization: Instead of storing sensitive card details, systems replace them with unique tokens.

-

PCI DSS Compliance: Adhering to Payment Card Industry Data Security Standards ensures best practices in payment processing.

These measures ensure that even if cybercriminals intercept information, they cannot use it.

5. Strong Authentication and Access Controls

Retailers also use multi-layered authentication to protect accounts and internal systems. This may include:

-

Two-factor authentication (2FA): Customers and employees may need both a password and a mobile code to log in.

-

Role-based access controls: Only authorized staff can access sensitive data, reducing insider risks.

-

Regular password updates: Encouraging or requiring secure passwords helps prevent unauthorized access.

This balance of convenience and security keeps information in the right hands.

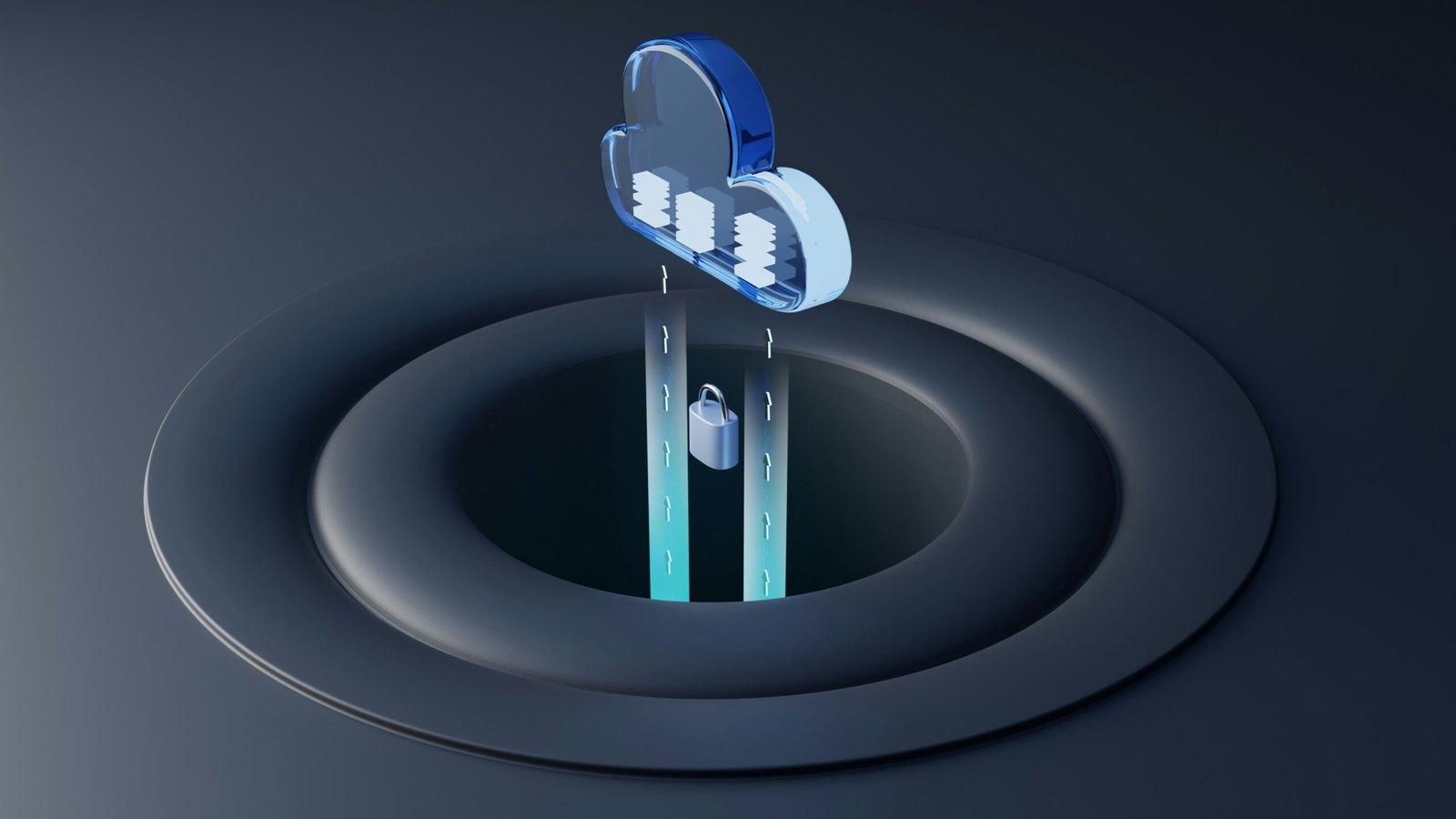

6. Data Encryption and Secure Storage

Retailers rely heavily on encryption not only during transactions but also in data storage. Sensitive information such as addresses, payment records, or identification numbers is encrypted within databases. Cloud-based systems also follow strict encryption protocols.

By ensuring encrypted storage, even if cybercriminals gain access to databases, the information remains unreadable.

7. Compliance with Privacy Laws and Regulations

Privacy laws are growing stricter worldwide, and retailers take active measures to stay compliant. Common frameworks include:

-

GDPR: Requires explicit consent for data collection, provides rights to access, delete, or correct information.

-

CCPA: Grants California residents rights to know what data is collected and to opt out of data selling.

-

Children’s Online Privacy Protection Act (COPPA): Protects children’s data when retailers target younger audiences.

Retailers invest in compliance training, software systems, and legal teams to ensure adherence to these laws.

8. Customer Control over Data

A major trend in retail privacy is giving customers control over their information. Retailers now provide options such as:

-

Downloading personal data on request.

-

Requesting deletion of data (“right to be forgotten”).

-

Opting out of marketing communications with a single click.

-

Managing cookie preferences on websites.

When customers control their information, they feel empowered and more trusting toward the retailer.

9. Employee Training and Awareness

Human error is one of the leading causes of data leaks. To counter this, retailers regularly train employees on:

-

Identifying phishing attempts.

-

Safely handling sensitive information.

-

Using secure devices and networks.

-

Understanding legal responsibilities for data protection.

A well-informed workforce is a critical layer of defense.

10. Cybersecurity Measures and Threat Detection

Retailers also invest heavily in advanced cybersecurity tools. Common measures include:

-

Firewalls and intrusion detection systems to monitor unauthorized access attempts.

-

Anti-malware software to block malicious attacks.

-

Regular vulnerability testing to find and fix weak points in networks.

-

Incident response teams that act quickly if breaches occur.

By staying ahead of evolving cyber threats, retailers keep consumer information secure.

11. Privacy by Design in Technology

Modern retailers adopt a “privacy by design” approach. This means building privacy features directly into technology, rather than treating it as an afterthought. For example:

-

Mobile apps request permissions only when necessary.

-

Websites limit cookies to essential functions unless users give consent.

-

Retail systems are developed with built-in encryption and access controls.

This approach ensures that privacy protection is automatic and consistent.

12. Partnerships with Trusted Vendors

Retailers often rely on third-party vendors for services like shipping, cloud storage, or analytics. Protecting consumer privacy requires ensuring these vendors also follow strict guidelines. Many retailers:

-

Sign data protection agreements with partners.

-

Audit vendor systems for compliance.

-

Avoid sharing unnecessary customer data with third parties.

This careful management of external partners reduces risks outside the retailer’s direct control.

13. Balancing Personalization with Privacy

Many customers enjoy personalized shopping experiences—tailored recommendations, loyalty offers, and special discounts. However, personalization relies on data collection. Retailers protect privacy while delivering personalization by:

-

Using anonymized or aggregated data for recommendations.

-

Allowing customers to opt in to personalization.

-

Clearly explaining how data improves the shopping experience.

This balance ensures personalization does not come at the cost of privacy.

14. Data Retention and Disposal Policies

Keeping data longer than necessary can be risky. Retailers implement retention policies that:

-

Automatically delete inactive accounts after a certain period.

-

Securely erase outdated payment or shipping records.

-

Archive only anonymized or non-sensitive data for long-term analytics.

Proper disposal of old data minimizes exposure risks.

15. Building Consumer Trust

Ultimately, protecting consumer privacy is about building trust. Retailers show responsibility by:

-

Issuing transparent privacy reports.

-

Communicating openly if a breach occurs and taking corrective actions.

-

Engaging in certifications and privacy seals that show compliance.

When consumers see that retailers are proactive, they feel confident continuing their relationship with them.

Conclusion

Retailers today face a delicate balance: collecting enough data to deliver seamless, personalized experiences while ensuring consumer privacy remains intact. From transparent policies and minimized data collection to encryption, compliance, and employee training, a multi-layered approach protects sensitive information.

As technology evolves, privacy protection will continue to be a moving target. But retailers who prioritize security, transparency, and consumer control are not only complying with the law—they are also building the trust and loyalty that keep their businesses thriving.